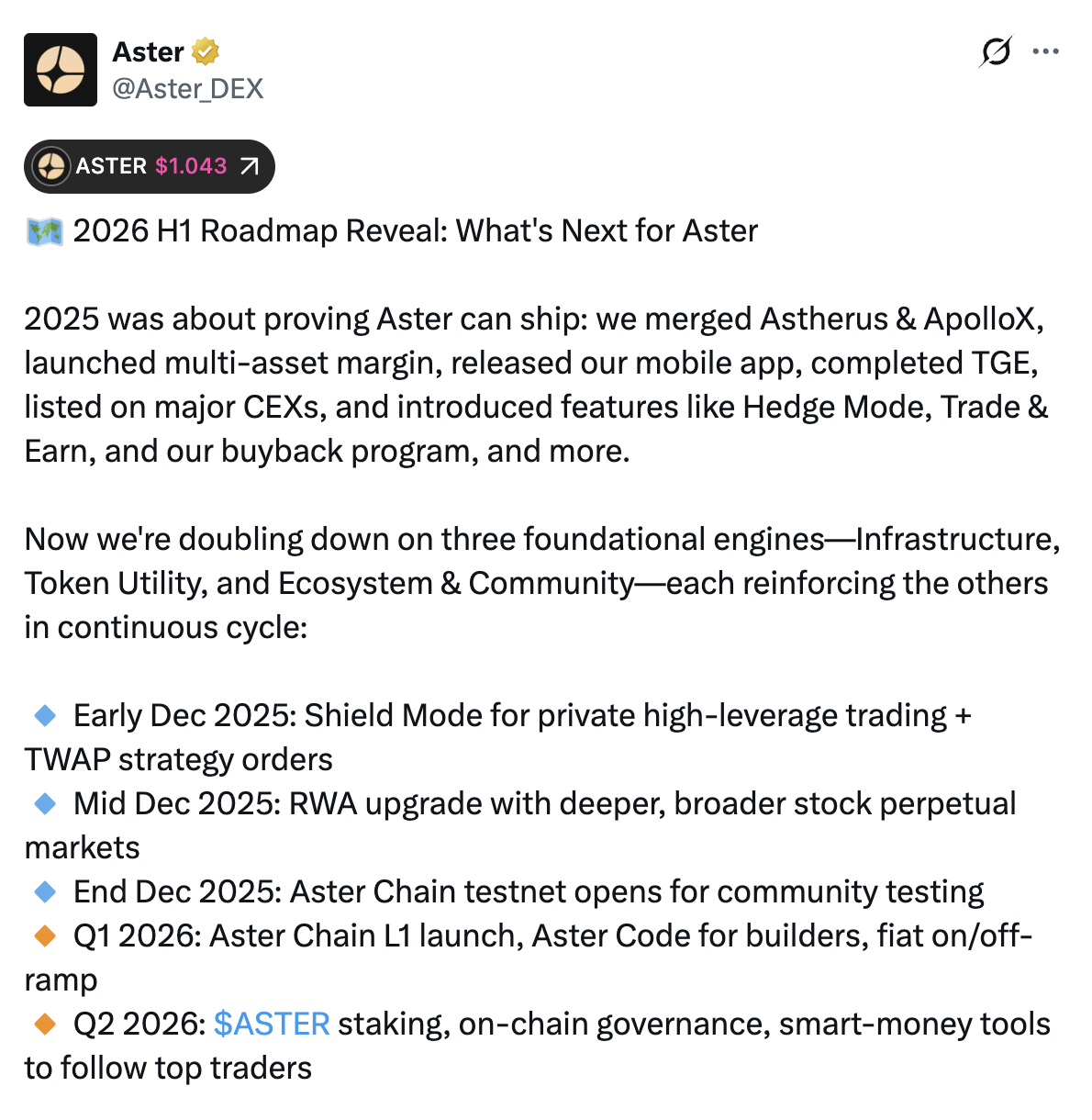

Aster has unveiled its 2026 H1 roadmap

Aster has rolled out its 2026 H1 roadmap, signaling a massive pivot from rapid expansion to full-blown infrastructure dominance. After a whirlwind 2025 packed with mergers, TGE, mobile apps, and CEX listings, the team is gunning for Layer-1 independence and community-driven growth. This is a blueprint for turning Aster into a DeFi powerhouse.

Image Source: Aster

2025 Milestones

Aster's team didn't mince words: 2025 was their breakout year. The Astherus-ApolloX merger fused expertise, the token generation event unlocked liquidity, a slick mobile app hit app stores, and listings on top exchanges like XT and MEXC drew crowds. Market watchers like Lucas Hart called it "unusually paced delivery" for a project still building core tech. These wins built momentum, with $ASTER whales scooping up millions amid buyback burns worth $80M just days ago. Now, eyes are on execution as Aster shifts gears.

December Sprint

Early this month, Shield Mode rolls out for privacy-shielded high-leverage trades using zero-knowledge tech, perfect for whales dodging front-runners. TWAP strategies follow, slicing slippage via time-weighted average pricing for pro traders. Mid-month brings RWA stock perpetual upgrades, expanding futures to real-world assets with deeper liquidity. Capping it off: the Aster Chain testnet by month-end, inviting community stress-testing before Q1 liftoff. These tweaks promise smoother UX and beefier markets right now.

Q1 2026

Aster Chain L1 mainnet in Q1 2026. Ditching multichain dependency, this custom Layer-1 packs sub-second finality, dirt-cheap fees, and native perps with on-chain order books. Privacy gets a boost via ZK options, while Aster Code lowers barriers for builders to plug in apps and strategies. Fiat on/off-ramps integrate seamlessly, bridging TradFi. It's Aster taking the wheel for scalability and sovereignty, reducing external chain risks.

Q2 Power Plays

Q2 amps community control with ASTER staking for juicy yields and network security, plus on-chain governance letting holders vote on protocol upgrades. Smart order-following tools let users copy top traders' moves in real-time, blending social vibes with DeFi edge. Expect leaderboards tracking live trades, fueling viral engagement. This trifecta cements $ASTER utility, rewarding loyalty while decentralizing power.

What It Means for Traders

Aster's roadmap screams ambition: from DEX to self-sovereign ecosystem. Infrastructure like L1 tackles scalability, token utility via staking/governance drives demand, and community features spark virality. With recent burns tightening supply and Binance listing talks simmering, $ASTER could ride this wave hard—though volatility looms in choppy markets. Traders, gear up: testnet drops soon, mainnet beckons. Aster's not playing catch-up; it's redefining DeFi's front lines.

Leave a Comment