Bunni Shuts Down After Exploit

Bunni, one of the leading DeFi project, has announced its shutdown following a significant exploit that compromised its smart contracts. The incident underscores not only the risks inherent in DeFi but also the urgent need for robust security measures in an increasingly complex blockchain ecosystem.

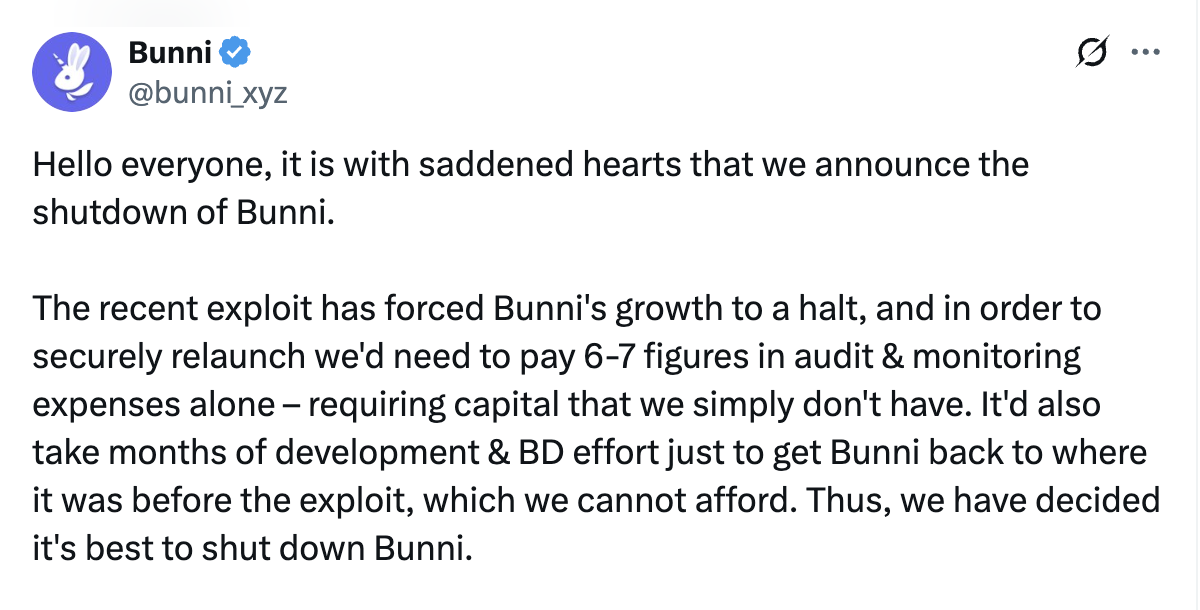

Image Source: Bunni

The Rise of Bunni

Launched earlier this year, Bunni has attracted thousands of users and gained good attention in the DeFi space for its innovative approach to yield farming and liquidity pools, with high returns for users through community-driven governance and smart contract automation. Many viewed Bunni as a potential player capable of reshaping the DeFi landscape with its user-friendly interface and promising features.

The Exploit Unveiled

On September 2, 2025, Bunni’s smart contract code was exploited by hackers, which resulted in the draining of a considerable amount of pooled funds. Details remain somewhat scarce, but initial investigations suggest that flaws in the project’s code allowed hackers to bypass certain security protocols, access the liquidity pools, and siphon off assets. The breach not only drained user funds but also revealed weaknesses in Bunni’s security infrastructure, casting doubts on the project's overall robustness. The team behind Bunni quickly confirmed the exploit and, in a move that shocked its community, decided to shut down the project entirely to prevent further damage.

An Emotional Farewell

In a statement released on social media, Bunni’s development team expressed regret over the incident and apologized to its community. “We built Bunni with the vision of creating an inclusive, innovative DeFi platform. Sadly, vulnerabilities in our code led to this exploit. We believe it’s best to shut down to protect our users and learn from this experience” they said.

The announcement sparked discussions about security, responsibility, and the rapid pace of innovation in DeFi across the crypto community. Many users expressed disappointment but also an understanding that security must be the top priority, especially in a space rife with sophisticated cyber threats.

A Broader Industry Reflection

The fall of Bunni is not an isolated incident. Over the past year, several DeFi projects have faced similar challenges, underscoring the persistent risks of smart contract vulnerabilities. Despite rigorous audits, malicious actors continually find new ways to exploit even the most carefully coded protocols, often resulting in devastating losses. Industry experts warn that the Bunni exploit serves as a stark reminder for investors and developers alike. The rapid advancement of DeFi technology requires equally swift development of security standards and auditing practices.

Future Outlook

Bunni’s shutdown highlights the resilience of the DeFi space, learning, adapting, and improving after setbacks. Many teams are doubling down on security audits, implementing multisignature wallets, and engaging in bug bounty programs to prevent similar incidents in the future. For users, the key takeaway is the importance of caution and due diligence. Exercise caution when investing in new projects, especially those with limited security audits. The fast-growing DeFi ecosystem remains an exciting frontier for innovation but demands vigilance.

Final Thoughts

The closure of Bunni marks a sobering moment for DeFi, emphasizing that even promising projects are not immune to vulnerabilities and exploits. While this incident sullies the reputation of DeFi’s fast-paced innovation, it also acts as a catalyst for strengthened security protocols and maturity within the industry.

Leave a Comment