CFTC unveils a 35 member Innovation Advisory Committee

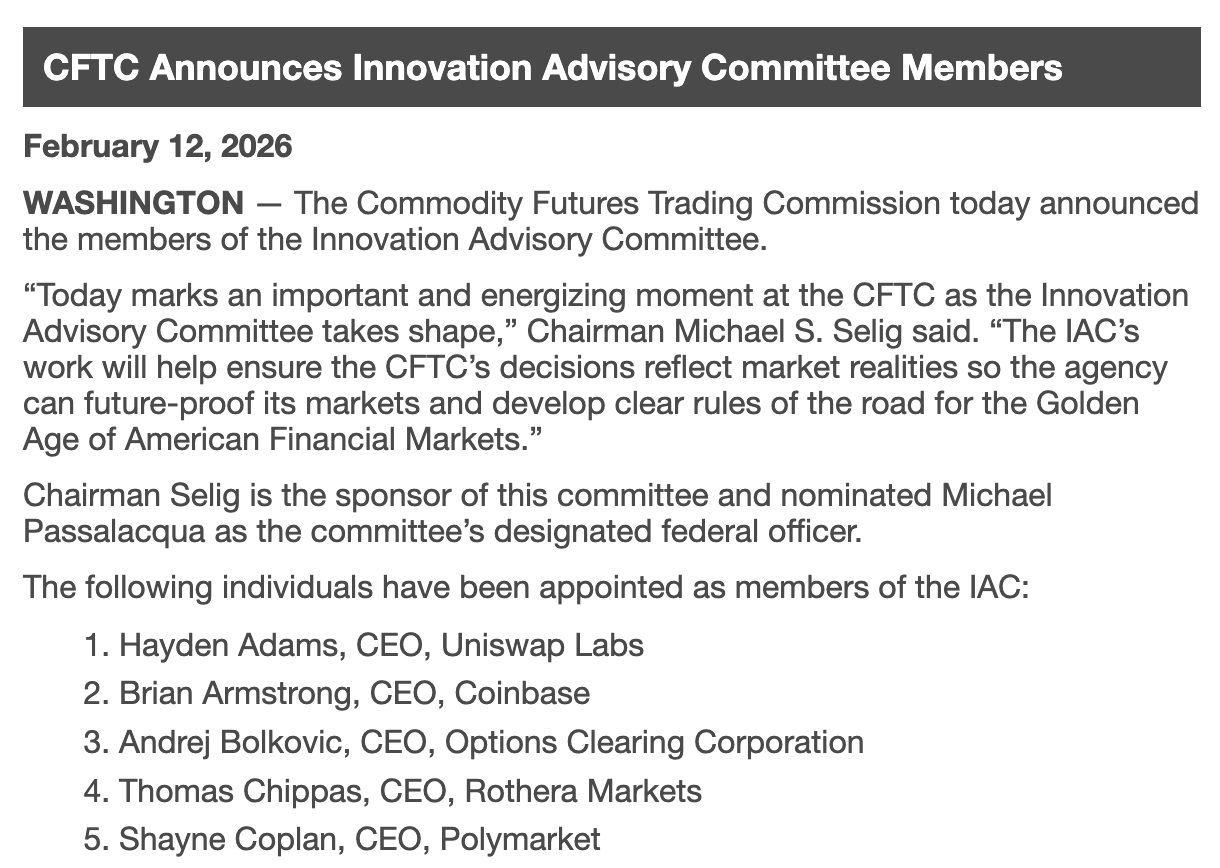

The U.S. Commodity Futures Trading Commission (CFTC) has unveiled its new 35-member Innovation Advisory Committee. Announced this week, the committee brings together a powerhouse lineup of tech pioneers, financial heavyweights, academics, and regulators to guide the agency through the wild frontiers of digital assets, blockchain, and emerging markets.

Image Source: CFTC

A Star-Studded Lineup

This committee is a dream team blending Silicon Valley disruptors, Wall Street veterans, and policy wonks. The committee boasts 35 diverse voices, including executives from crypto exchanges like Coinbase and Kraken, blockchain innovators from ConsenSys, legal eagles from firms like Sullivan & Cromwell, and academics from MIT and Stanford. Notable names include former CFTC Commissioner Brian Quintenz, now at a16z crypto, and tech leaders from Ripple and Chainalysis. This is a deliberate mix designed to bridge the gap between bleeding-edge tech and time-tested regulation. The CFTC, long tasked with overseeing derivatives and commodities, has been under pressure to adapt to DeFi, NFTs, stablecoins, and AI-driven trading. This committee steps in as an official advisory body, meeting regularly to dissect trends, flag risks, and recommend policies.

Why This Matters

The CFTC's proactive stance comes amid a regulatory tug-of-war with the SEC, where overlapping jurisdictions have stifled innovation. This committee could tip the scales toward clarity, potentially fast-tracking approvals for new products like spot ETFs or decentralized perpetuals. For global players, it's a beacon. With the EU's MiCA framework live and Asia's hubs like Singapore thriving, the U.S. risks falling behind. The committee's focus on "innovation" underscores a shift from pure enforcement to collaboration. Early signals suggest priorities like cybersecurity in DeFi and sustainable blockchain scaling, aligning with broader economic goals like energy-efficient proof-of-stake networks. Critics, however, caution against industry capture, urging diverse consumer protection voices.

What's Next?

Expect the committee's first meetings in Q2 2026, with public reports and recommendations flowing by year-end. They could influence everything from CFTC rulemaking to congressional testimony, potentially paving the way for a unified digital asset framework. For startups and traders, this means less guesswork and more growth runway. In the end, this 35-member brain trust is architecting crypto's American chapter. As markets evolve faster than ever, the CFTC's embrace of innovation could turn regulatory headwinds into tailwinds, fostering a safer, more vibrant ecosystem.

Leave a Comment