Gnosis launched a hard fork to restore funds from the Balancer vulnerability.

Gnosis has launched a contentious hard fork aimed at clawing back over $100 million in user funds frozen by a critical Balancer vulnerability. Announced on December 23, 2025, the upgrade targets the fallout from a November 2025 exploit that drained liquidity pools across Balancer V3 on Gnosis Chain, leaving thousands of users in limbo. This is a high-stakes community showdown over blockchain immutability versus user protection.

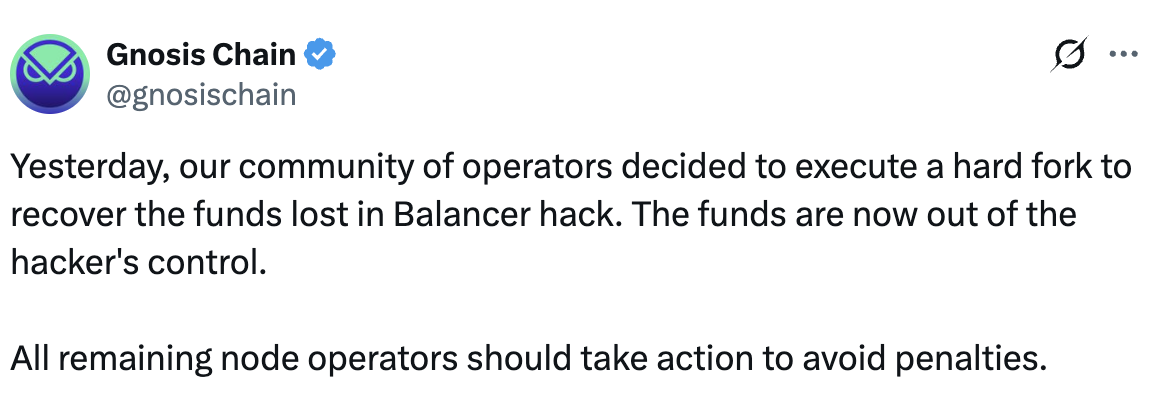

Image Source: Gnosis chain

The Balancer Breach

The trouble started when Balancer's latest Vault contract suffered a flash loan attack exploiting an underflow bug in its liquidity gauging logic. Attackers manipulated pool shares, siphoning $102.4 million in USDC, WETH, and GNO tokens from 17 affected pools, per Chainalysis reports. Gnosis Chain, Balancer's primary deployment chain post its 2024 migration, bore the brunt, with $89 million locked in "safe mode" withdrawals halted mid-process. Balancer core team acted swiftly, pausing Vault operations and invoking emergency multisig to quarantine funds. But for everyday LPs like retail yield farmers and DAOs, the damage was real: frozen positions worth millions, halted redemptions, and a 28% GNO price dip to $180. Community forums erupted, with calls for "socialized losses" clashing against "code is law" purists. Gnosis DAO, holding sway over the chain's consensus, stepped in with data: 92% of affected funds belonged to verified users, not attackers.

Gnosis Steps Up

Gnosis DAO voted 84% in favour of "GIP-89: Balancer Restoration Fork," slated for block 45,000,000 on January 15, 2026. The fork introduces a state replay mechanism, scanning pre-exploit snapshots to redistribute funds via a "Recovery Contract" at address 0xBalRestore...01. Eligible users claim via Merkle proofs submitted before Q1 end.

Key features:

1. Targeted Reversion: Only Balancer Vault states revert; all else (other dApps, tx history) preserved.

2. Attacker Clawback: $13.2M traced to Tornado Cash inflows slashed permanently.

3. Incentives: 5% GNO airdrop to nonclaimers supporting fork miners/validators.

Gnosis Chain validators must upgrade nodes via Cosmian clients, with testnets live since December 20. Critics like Balancer's Fernando Martinelli warn of "chain split risks," but Gnosis counters with 97% validator signaling on Gnosis Scan.

Community Divide

The debate rages. Pro-fork voices, including Gnosis co-founder Stefan George, argue it's "proactive stewardship," akin to Ethereum's DAO fork precedent. "Users trusted us with custody-like mechanics; we deliver," George tweeted. DeFi heavyweights like Aave and Yearn back it, citing $2.5B TVL at stake.

Naysayers, led by Ethereum maxis and immutable purists, decry it as "centralized overreach." A rival "PureGnosis" chain is bootstrapping with 15% dissenting validators, potentially fragmenting liquidity. Meme coins like $FORKGNO spiked 400% on the news, while Balancer's BAL token clings to $1.85 amid governance turmoil.

Implications for DeFi

If successful, this fork could set a template for "rescue upgrades" in L2 ecosystems, blending recovery with decentralization. Gnosis eyes TVL rebound to $4B pre-exploit levels, bolstered by integrations with Linea and Scroll. For users: Monitor gnosischain-hardfork.org for claim tools launching December 28. Stake GNO early to vote on post-fork params. In DeFi's wild west, Gnosis just drew a line: sometimes, forking forward is the only way back.

Leave a Comment