Kadena Shuts Down Its Operations

Kadena, once hailed as the “blockchain for business,” announced that it is winding down its operations. The news, which broke on Tuesday, triggered an immediate market reaction, the Kadena (KDA) token plunged over 60% within hours, crashing to around $0.09, a steep fall from its all-time high of $27.64 reached in 2021.

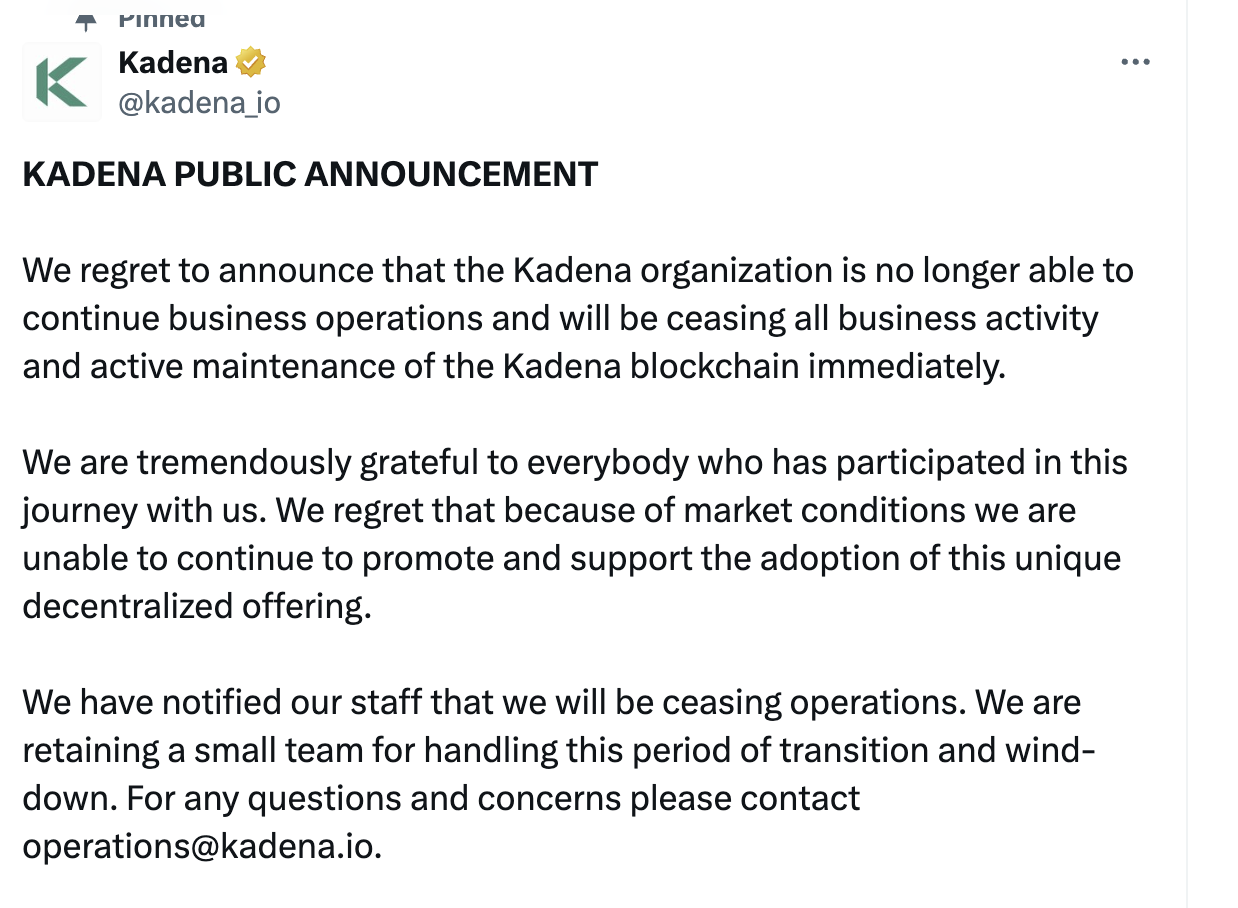

Image Source: Kadena

A Sudden End to a Bold Vision

In an official statement posted on X (formerly Twitter), the Kadena organization said it “is no longer able to continue business operations and will be ceasing all business activity and active maintenance of the Kadena blockchain immediately.” The team attributed the decision to unfavorable market conditions and the declining ability to promote adoption of its decentralized technology. Despite the shutdown, the organization clarified that the Kadena blockchain itself will remain online, as it is operated by independent miners and validators, rather than the core development team. The company added that developers are preparing a new software update that will allow the network to continue running autonomously without centralized oversight.

A Project with High Hopes and Heavy Burdens

Founded in 2016 by Stuart Popejoy and Will Martino, Kadena aimed to revolutionize blockchain efficiency through a hybrid proof-of-work (PoW) network capable of parallel chain execution. The project positioned itself as a high-performance, enterprise-grade blockchain offering the scalability of newer networks without sacrificing security.

At its peak, Kadena attracted institutional attention and venture funding totaling around $15 million, touting partnerships and programs to stimulate adoption. However, as the crypto landscape became more competitive and venture capital dried up, the company’s operational costs grew unsustainable. Even multiple incentive packages, including a $100 million ecosystem grant in 2022 and a smaller follow-up in 2025, failed to reignite traction.

Blockchain to Continue Without the Core Team

While Kadena’s corporate entity is dissolving, the decentralized nature of its blockchain infrastructure ensures that the network will not disappear overnight. Independent miners will continue validating transactions, and roughly 566 million KDA tokens remain scheduled for distribution as mining rewards through the year 2139. A small transition team will manage the shutdown and coordinate with community maintainers to sustain network continuity. The Kadena team also emphasized that forthcoming updates would allow community-led governance to take over key decisions, marking a shift from corporate control to decentralized stewardship.

Market Impact

The announcement sent traders into a frenzy, leading to one of the sharpest single-day drops in the project’s history. According to CoinMarketCap, KDA’s market capitalization has fallen from a peak of nearly $4 billion in November 2021 to roughly $30 million today. The collapse further intensified concerns over the sustainability of smaller blockchain projects struggling to survive in a market increasingly dominated by giants like Ethereum and Solana. Many long-term holders admitted being blindsided, as Kadena had recently announced incentive programs aimed at reviving its ecosystem. The sharp decline has been described as one of the most significant token collapses of 2025.

Final Thoughts

Kadena’s fall stands as a stark reminder of the volatility and financial fragility facing blockchain startups. Despite technical innovation, competing against larger ecosystems remains a challenge few smaller projects can overcome. As the market consolidates, many teams face the difficult choice between restructuring or shuttering operations entirely.

Leave a Comment