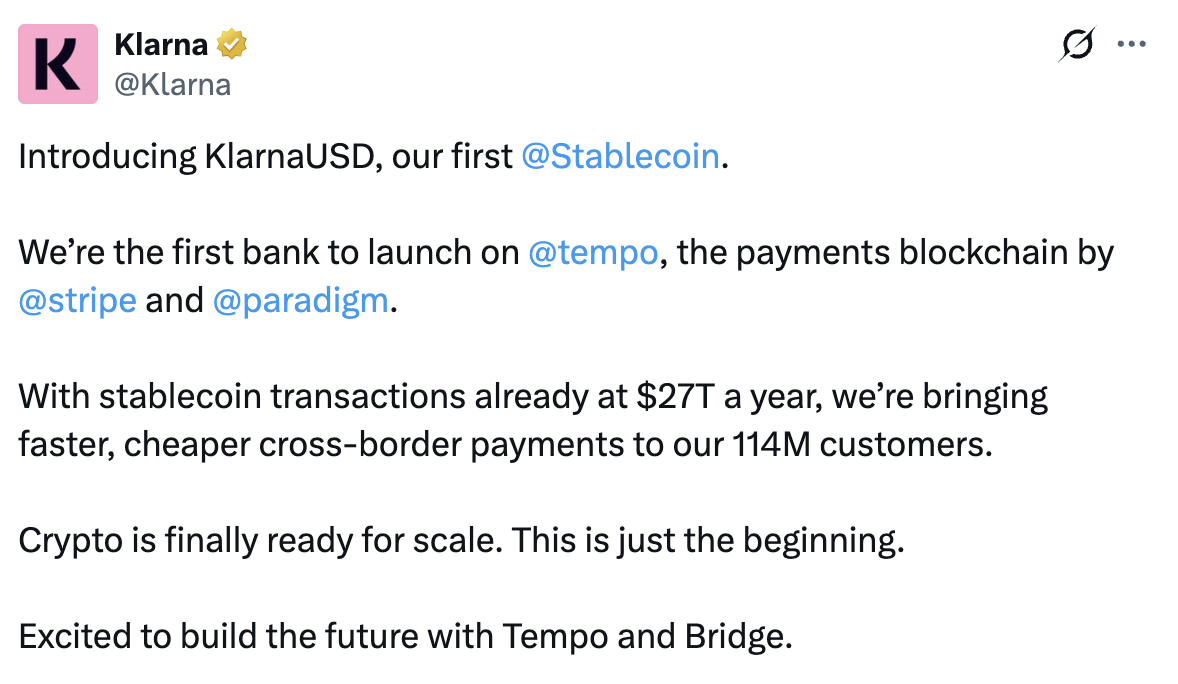

Klarna Unveils KlarnaUSD Stablecoin on Tempo

Sweden based Klarna has announced the launch of its KlarnaUSD, a U.S. dollar‑backed stablecoin built on Stripe’s Tempo blockchain. The move positions Klarna as the first bank to issue a stablecoin on Tempo, signaling how mainstream fintechs are now embracing blockchain rails to modernize global payments.

Image Source: Klarna

Klarna’s Strategic Leap Into Stablecoins

Klarna’s new token, KlarnaUSD, is designed as a fully collateralized stablecoin pegged 1:1 to the U.S. dollar and aimed squarely at payment use cases rather than speculation. The stablecoin is currently live on Tempo’s testnet, with a mainnet launch planned for 2026, giving partners, merchants, and developers time to integrate and stress‑test the new rails. For Klarna, which processes over $100 billion in annual gross merchandise value and serves more than 100 million customers worldwide, the stablecoin marks one of its most significant strategic shifts since entering the U.S. market. By issuing KlarnaUSD, the company is moving from simply routing card and BNPL transactions to owning a slice of the underlying settlement infrastructure.

Why Tempo Blockchain Matters

Tempo is a new independent Layer‑1 blockchain purpose‑built for payments and co‑founded by Stripe and crypto investment firm Paradigm. Launched in September 2025, Tempo is optimized for speed and cost efficiency, with claims of processing over 100,000 transactions per second and achieving sub‑second finality, metrics that directly target pain points in legacy cross‑border payment rails. Tempo focuses on predictable low fees, the ability to pay gas in stablecoins, and optional privacy features for sensitive payment data. It is also EVM‑compatible, meaning applications and smart contracts built for Ethereum can be ported with relatively low friction, which is crucial for adoption by existing Web3 developers and payment partners.

Cutting Costs in a $120 Billion Fee Market

KlarnaUSD is being pitched as an answer to the high cost and friction of cross‑border payments, a segment where fees are estimated at around $120 billion annually. By settling over Tempo instead of traditional correspondent banking networks such as SWIFT, Klarna aims to move money faster between markets while reducing the layers of intermediaries that add cost and delay. Initially, Klarna plans to use KlarnaUSD for its own internal treasury flows and merchant settlements. Over time, access is expected to expand to merchants and eventually consumers, giving users a way to pay, settle, or move balances using a stable digital dollar within Klarna’s ecosystem.

Deepening Ties With Stripe and Bridge

The stablecoin is issued through Bridge, Stripe’s dedicated stablecoin infrastructure product, and Tempo serves as the underlying blockchain layer for that stack. Klarna and Stripe first partnered in 2021 to let Stripe merchants offer Klarna’s BNPL services, and Tempo now extends that relationship from front‑end checkout to the core settlement layer. By plugging into Stripe’s crypto and stablecoin stack, Klarna can tap an existing network of global merchants and financial partners rather than building an issuance and settlement infrastructure from scratch.

Regulatory Landscape

KlarnaUSD will enter a crowded $300‑billion‑plus stablecoin market dominated by incumbents such as USDT and USDC. Klarna is betting that tight integration with checkout, BNPL services, and merchant tools will differentiate its token from purely crypto‑native stablecoins that focus on trading and DeFi. At the same time, launching a bank‑issued stablecoin exposes Klarna to heightened scrutiny over reserve transparency, consumer protection, and compliance with evolving digital asset rules in the EU and U.S. Company executives frame the rollout as gradual and deliberate, with testnet trials and phased access designed to address regulatory and operational risk before full‑scale consumer use.

Future of Payments

Klarna’s move underscores a broader shift: large fintechs are no longer treating crypto rails as experimental side projects but as core infrastructure for making payments faster, cheaper, and more programmable. If KlarnaUSD delivers on its promise of lower fees and near‑instant settlement, it could pressure traditional providers and accelerate enterprise adoption of payment‑focused blockchains like Tempo.

Leave a Comment