SEC Declares Crypto Liquid Staking Activities Are Not Securities

The U.S. Securities and Exchange Commission (SEC) declared that certain crypto liquid staking activities and their associated tokens are not considered securities under federal law. With the statement, published on August 5, 2025, the SEC has essentially eased years of regulatory anxiety hanging over some of the fastest-growing corners of decentralized finance (DeFi).

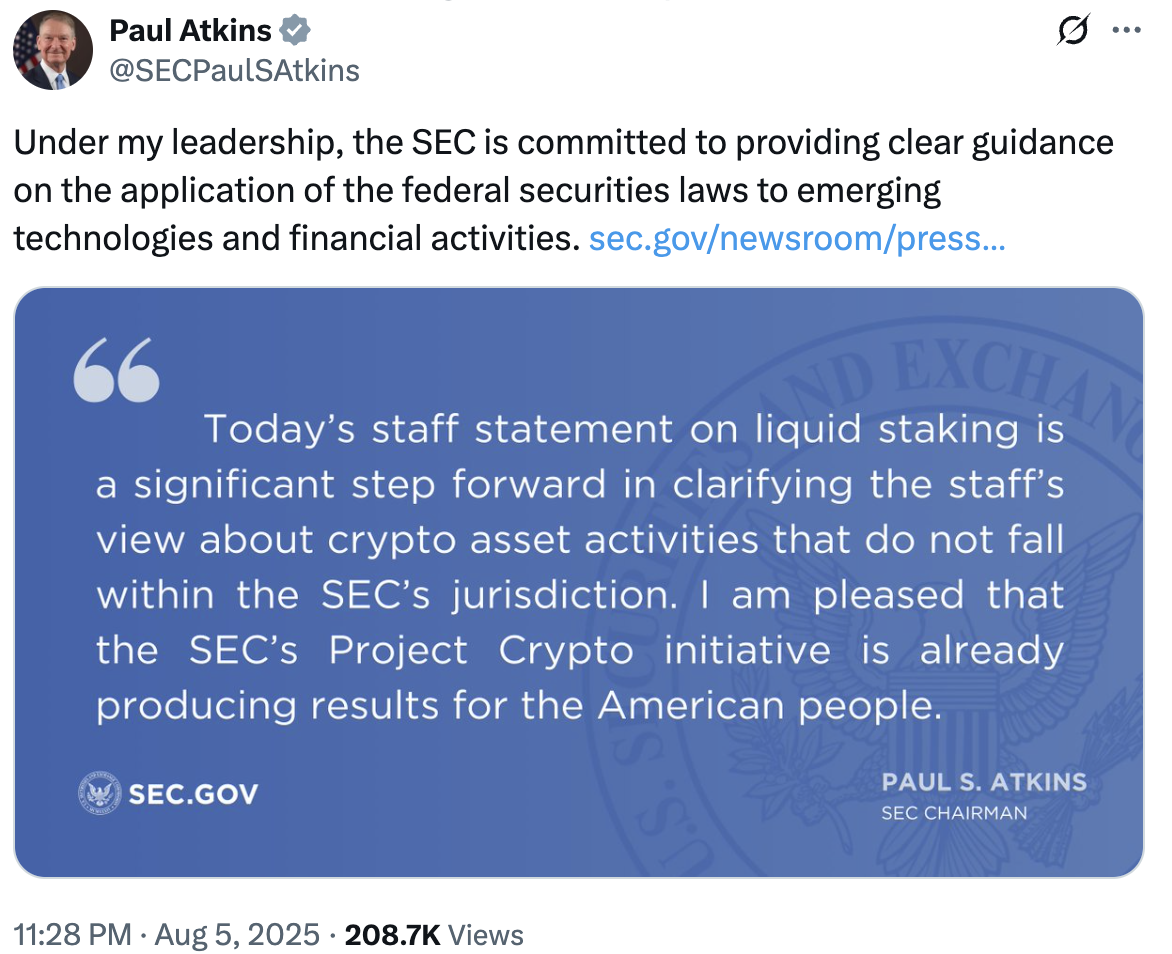

Image Source: Paul Atkins

What Is Liquid Staking, and Why Does It Matter?

Liquid staking allows investors to deposit their cryptocurrency into specialized staking protocols and receive “staking receipt tokens” in return. These tokens can then be traded or used in DeFi, while the underlying assets continue to earn staking rewards. The innovation has attracted immense capital, with nearly $67 billion worth of digital assets currently locked in liquid staking protocols, according to industry trackers. Ethereum alone accounts for over $51 billion of this stash, supporting everything from decentralized lending to NFT marketplaces.

The SEC’s Statement

The SEC’s Division of Corporation Finance, in its new guidance, declared that liquid staking arrangements as described do not constitute an “offer and sale of securities.” This means they are not subject to strict registration requirements under the Securities Act of 1933 or the Securities Exchange Act of 1934. The SEC clarified that “staking receipt tokens” are “mere receipts,” not financial instruments that carry rights to future profits or business management, which typically triggers securities law.

Industry Impact

It’s important to note this SEC stance is not a blanket approval for every DeFi related yield product. The agency’s statement highlighted that these activities do not apply to arrangements where the underlying token carries the rights or expectations typical of traditional securities like profit-sharing or management participation. Restaking protocols (such as EigenLayer) and yield-bearing instruments akin to bonds remain outside the scope of this guidance. For industry leaders, the statement is nothing short of transformative. The news is already spurring optimism for the inclusion of liquid staking-backed assets into exchange-traded funds (ETFs), especially for Ethereum and Solana products vying for mainstream integration.

Dissent and Ongoing Ambiguity

Not everyone at the SEC is fully on board. Commissioner Caroline Crenshaw voiced concern, cautioning that the division’s new stance “muddies the waters” and leaves vital questions unanswered for staking providers and consumers alike. Nonetheless, the wider industry sees the action as a historic regulatory detente.

Looking Ahead

The SEC’s position on liquid staking reflects the rapidly evolving understanding of digital finance in Washington. It is also a testament to the persistent calls from industry for workable, future-forward rules. As U.S. agencies continue to reconcile innovation with investor protection, Wednesday’s decision will be remembered as the day liquid staking stepped decisively out of the regulatory shadows and into the financial mainstream.SEC Declares Crypto Liquid Staking Activities Are Not Securities

Leave a Comment