SEC dropped a statement on broker-dealers custodying crypto asset securities

The U.S. Securities and Exchange Commission (SEC) dropped a statement clarifying how broker-dealers can custody crypto asset securities. Released amid ongoing debates over digital asset regulation, the guidance aims to provide a clearer path for traditional financial players entering the space. It's a pragmatic step forward, but not without its caveats, signaling the SEC's willingness to engage while upholding investor protections.

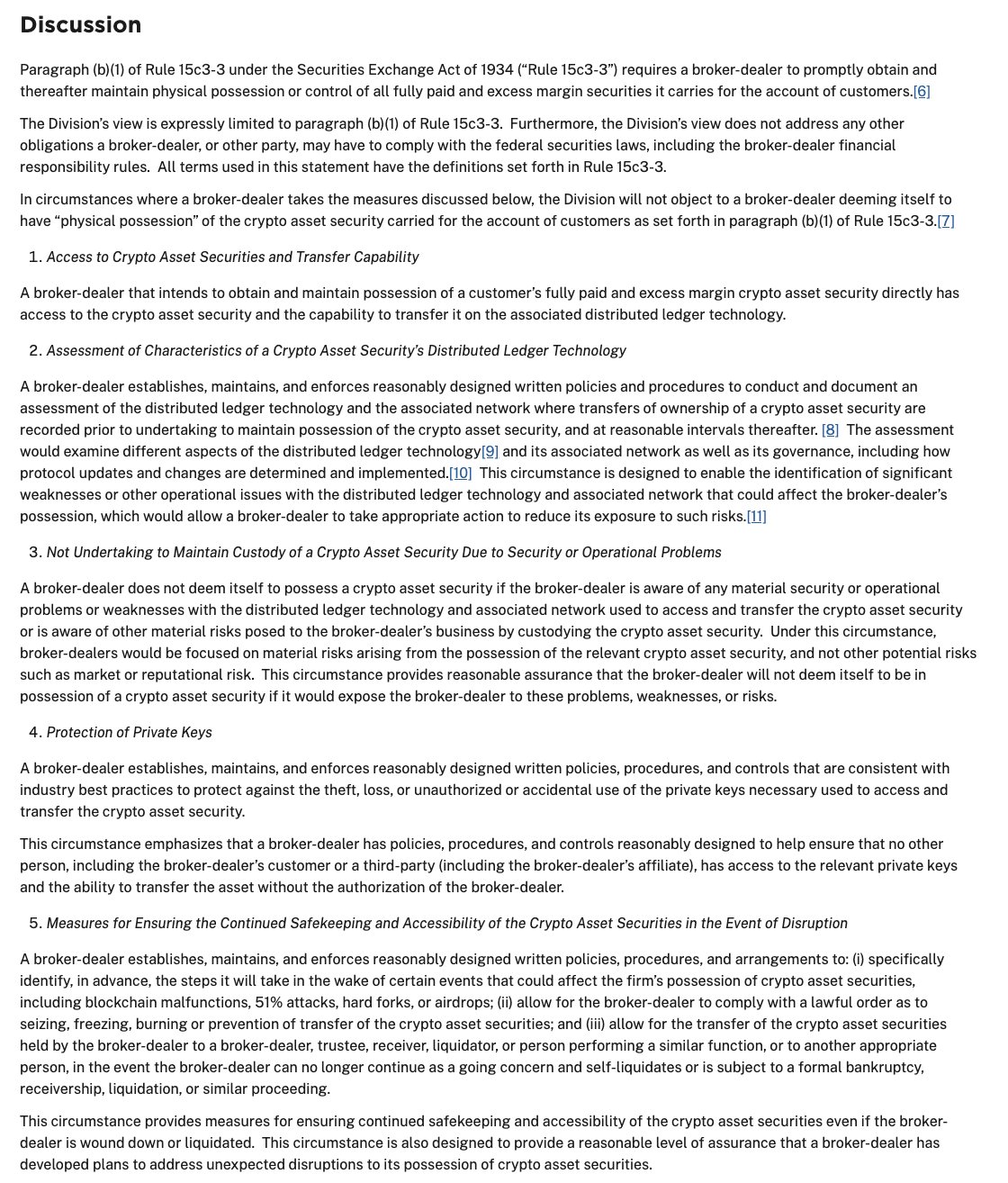

Image Source: SEC

What the Statement Covers

The core of the SEC's announcement focuses on Section 3(a)(23) of the Securities Exchange Act, which defines "clearance and settlement" activities. Broker-dealers seeking to custody crypto securities must now ensure their operations align with federal custody rules under Rule 15c3-3. This includes maintaining possession or control of customer assets, robust record-keeping, and regular reconciliations to prevent commingling with firm funds. No more "self-custody" loopholes where broker-dealers treat crypto like off-balance-sheet magic. The statement emphasizes qualified custodians, like banks or registered entities, must use technology that meets SOC 2 standards for security and availability. It's a nod to innovations like multi-signature wallets and hardware security modules, but only if they pass muster with the SEC's Division of Examinations.

Why This Matters for Crypto Custody

For years, crypto firms have navigated a regulatory gray zone, with cases like the FTX collapse highlighting custody risks. This guidance builds on prior no-action letters and speeches from SEC Chair Gary Gensler, who has long stressed that most cryptos aren't securities. Broker-dealers now have a roadmap: implement omnibus accounts with segregated private keys, conduct daily proofs of reserves, and disclose risks like slashing in proof-of-stake networks. Industry players are buzzing. Coinbase Custody and Fidelity Digital Assets, already registered, stand to benefit, potentially onboarding more institutional clients wary of pure-play crypto custodians. Smaller broker-dealers, however, face steep compliance costs.

Industry Reactions

Wall Street's response has been cautiously optimistic. A spokesperson for the Securities Industry and Financial Markets Association (SIFMA) called it "a constructive framework that bridges TradFi and crypto." Crypto advocates, like Blockchain Association CEO Kristin Smith, praised it as "progress toward legal clarity," urging the SEC to extend similar relief to decentralized exchanges. Critics, including some DeFi purists, argue it entrenches centralized control, stifling innovation. Hester Peirce, the SEC's "Crypto Mom," hinted at her blog that while helpful, the statement doesn't go far enough on non-security tokens. Market data shows a modest uptick: Bitcoin hovered around $95,000 post-announcement, with custody-focused stocks like Bakkt up 4%.

Implications for the Ecosystem

Expect ramped-up SEC exams in 2026, targeting weak controls. For broker-dealers, it's an invitation to innovate responsibly; for crypto natives, a reminder that Uncle Sam calls the shots on securities. As the industry matures, this guidance could unlock billions in tokenized assets, from RWAs to equity tokens. But it'll take collaboration. In the end, it's a win for clarity in a space desperate for it, proving regulation doesn't have to kill the golden goose.

Leave a Comment