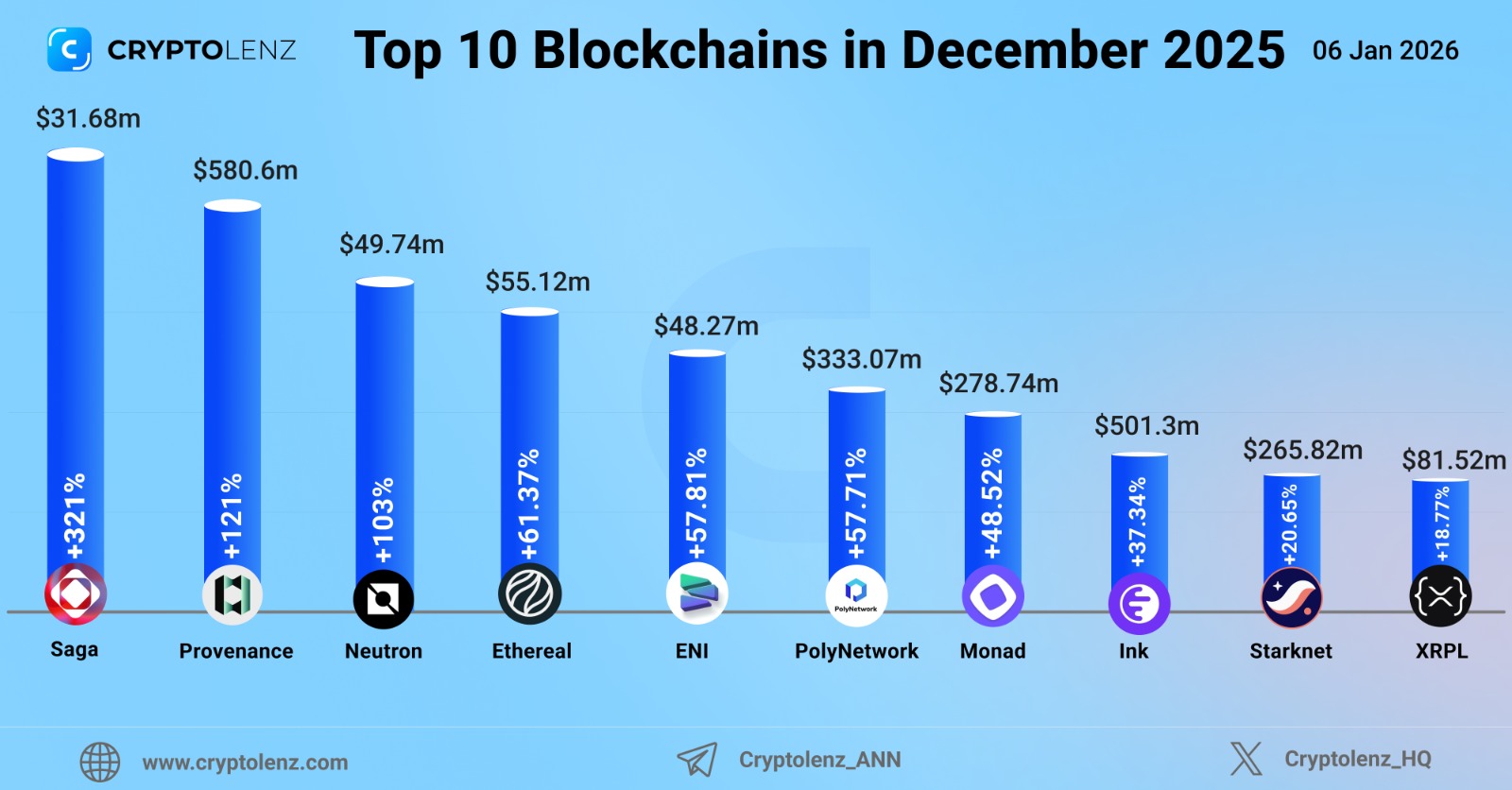

Top 10 Blockchains in December 2025 by TVL Growth

The DeFi landscape continues to evolve with blockchain ecosystems competing for dominance through innovative applications and strategic partnerships. Total Value Locked (TVL) is one of the key metrics to measure the health and attractiveness of these ecosystems. In this article, we have compiled a list of the top 10 blockchains in December 2025 by TVL growth, with a minimum Range of $10 million, using data from DefiLlama, a leading DeFi analytics platform.

What is TVL?

Total Value Locked (TVL) is a key metric in the decentralized finance (DeFi) ecosystem that represents the total U.S. dollar value of digital assets that are currently locked in DeFi platforms. These assets can include cryptocurrencies, stablecoins, liquidity tokens, and other digital assets used for various purposes such as staking, liquidity provision, and yield farming. It serves as an indicator of a DeFi platform's health and popularity, reflecting user trust and engagement.

Top 10 Blockchains in December 2025 by TVL Growth

The Following chains saw the highest TVL growth in December 2025

1. Saga

2. Provenance

3. Neutron

4. Ethereal

5. ENI

6. PolyNetwork

7. Monad

8. Ink

9. Starknet

10. XRPL

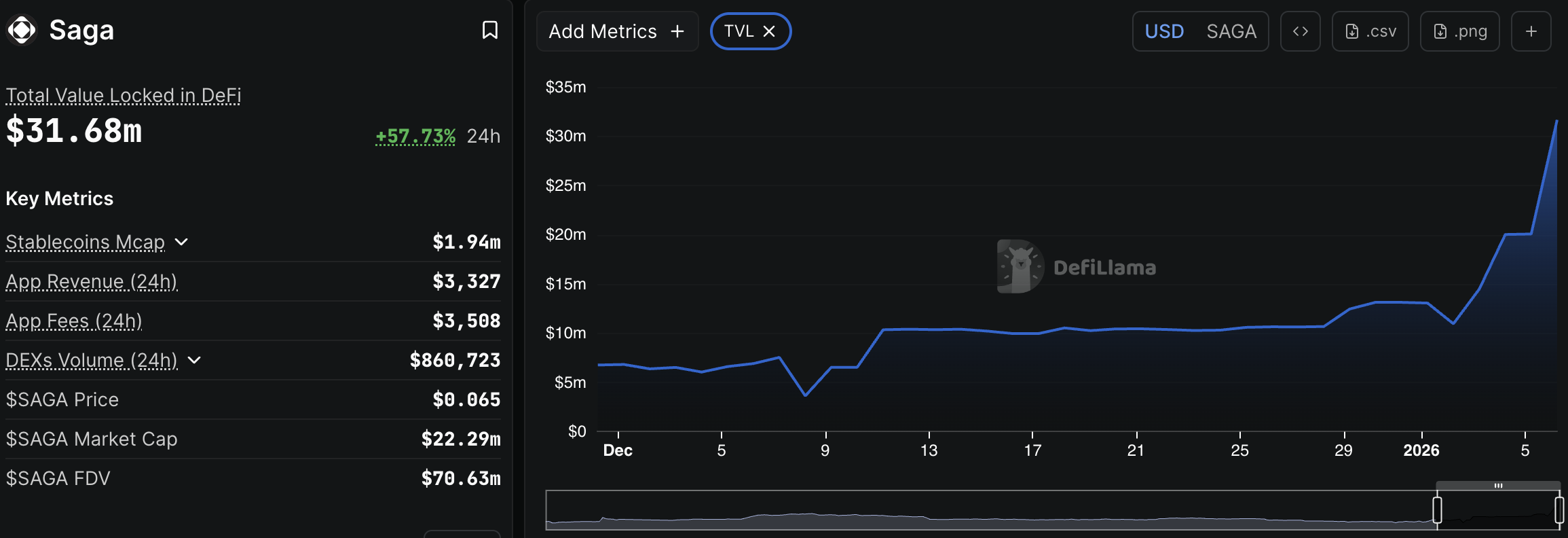

1. Saga

Saga tops the table with 321% growth in December 2025. Saga is a Layer 1 blockchain that lets developers launch their own application-specific blockchains with shared security, infinite horizontal scalability, and support for multiple VMs, heavily targeting Web3 gaming and entertainment. Its TVL is now valued at $31.68 million.

Top protocols that drive TVL Growth for Saga:

| Protocols | TVL Growth (Dec 2025) |

| Mustang Finance | +769% |

| Colt | +426% |

| YieldFi | +345% |

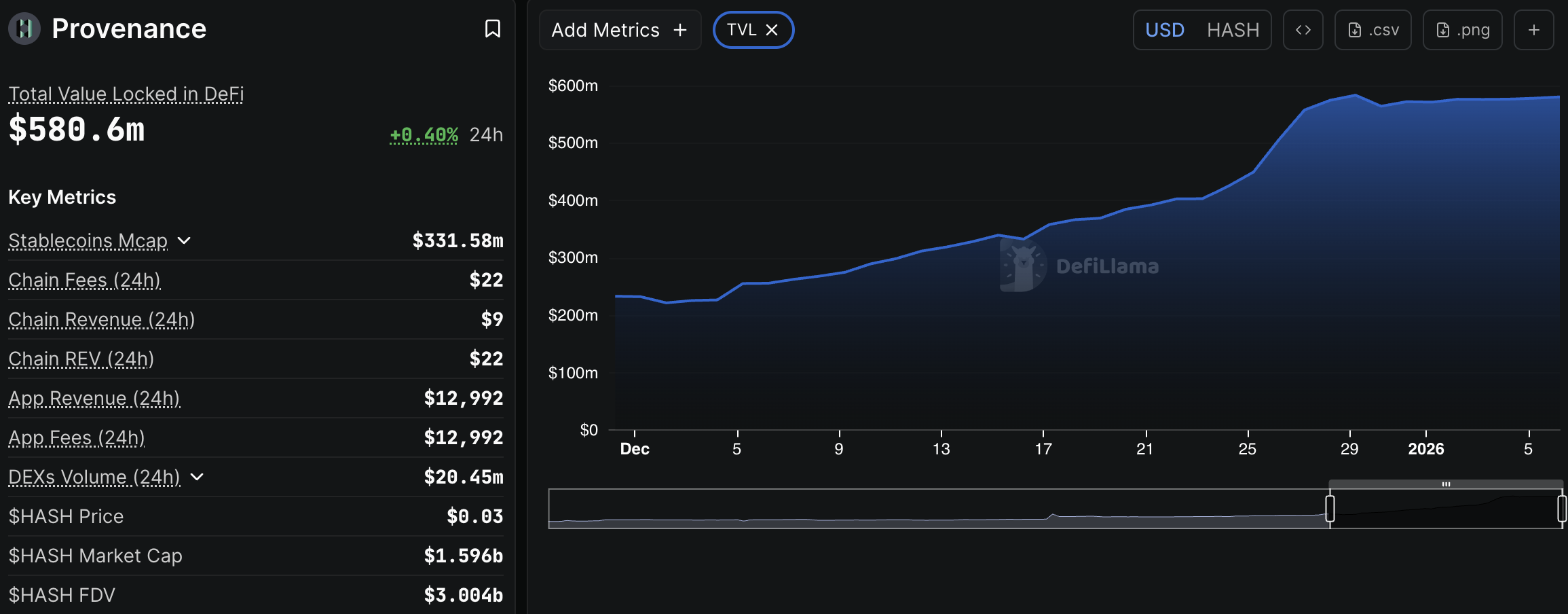

2. Provenance

Provenance comes in Second place with 121% growth in December 2025. Provenance is a secure, scalable platform designed to enhance transparency and trust in financial services and supply chains. It enables easy asset tokenization, streamlined compliance, and verifiable data sharing, empowering businesses with decentralized trust and operational efficiency. Its TVL is now valued at $580.6 million.

Top protocols that drive TVL Growth for Provenance:

| Protocol | TVL Growth (Dec 2025) |

| Figure Markets | +110% |

3. Neutron

Neutron comes in third place with 103% growth in December 2025. Neutron is a Cosmos SDK blockchain optimized for cross-chain DeFi and BTCFi, enabling secure smart contracts via CosmWasm. It leverages Interchain Security from Cosmos Hub, with native modules for interchain queries, accounts, oracles, and CRON automation. NTRN token powers fees, governance, and staking. Its TVL is now valued at $49.74 million.

Top protocols that drive TVL Growth for Neutron:

| Protocol | TVL Growth (Dec 2025) |

| Amber Finance | +785% |

4. Ethereal

Ethereal comes in fourth place with 61.37% growth in December 2025. Ethereal is a Layer-1 blockchain designed for scalable, secure, and gas-free transactions. It supports EVM-compatible decentralized apps, DeFi protocols, and Web3 gaming with institutional-grade PoS BFT security. Ethereal also powers a decentralized exchange (DEX) offering deep liquidity and fast execution. Its TVL is now valued at $55.12 million.

Top protocols that drive TVL Growth for Ethereal:

| Protocol | TVL Growth (Dec 2025) |

| Ethereal DEX | +61.30% |

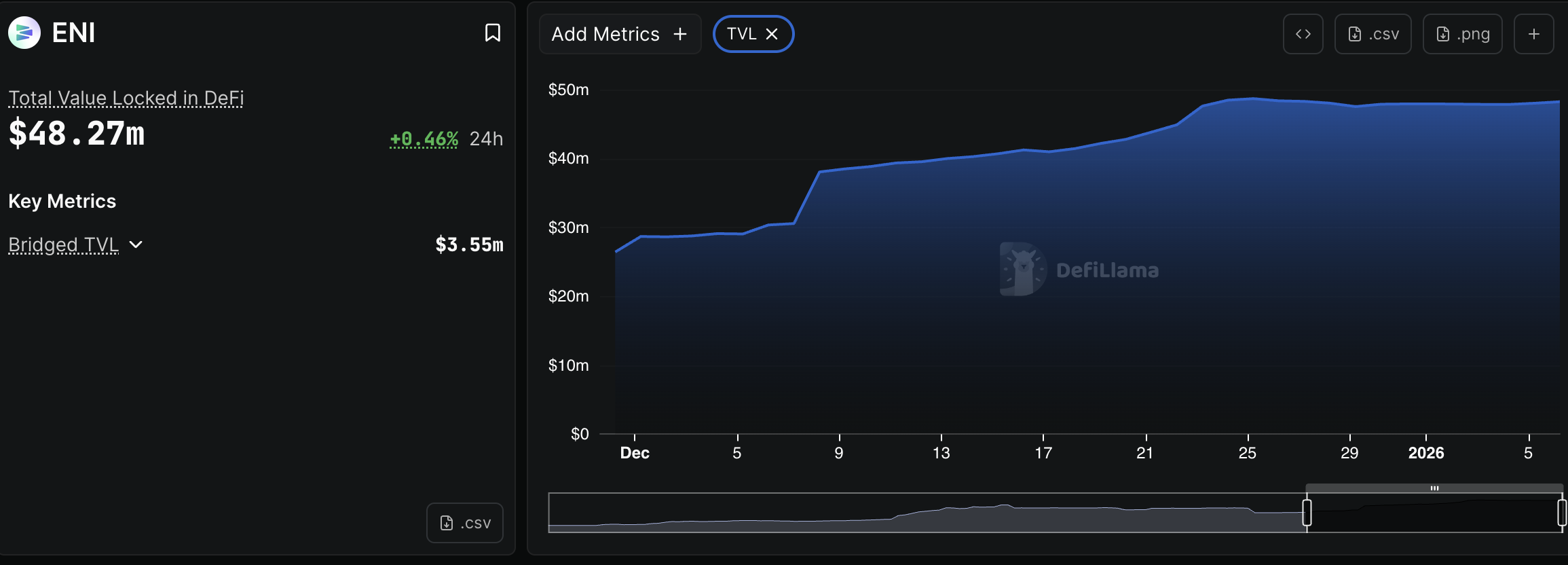

5. ENI

ENI comes in fifth place with 57.81% growth in December 2025. ENI is a high-performance, enterprise-grade Web3 blockchain leveraging Zero-Knowledge Proofs (ZKP) for privacy and scalability. Its modular, multi-chain design connects a mainnet with AppChains, delivering secure, decentralized infrastructure for businesses and developers. Focused on speed, stability, and real-world Web3 adoption. Its TVL is now valued at $48.27 million.

Top protocols that drive TVL Growth for ENI:

| Protocol | TVL Growth (Dec 2025) |

| Dswap | +57.82% |

6. PolyNetwork

PolyNetwork comes in sixth place with 57.71% growth in December 2025. PolyNetwork was a cross-chain interoperability protocol enabling asset transfers across over 20 blockchains like Ethereum, BSC, and Polygon via smart contracts and bridges, fostering DeFi and Web3 infrastructure. It gained notoriety in August 2021 after a massive $611 million hack exploited access control flaws in its cross-chain contracts. Facing repeated exploits and shifting market conditions, PolyNetwork fully terminated all services on September 30, 2024. Despite this, DefiLlama continues displaying its TVL at around $333.07 million as the platform tracks on-chain locked value via automated smart contract queries even for inactive or shutdown protocols, reflecting residual liquidity rather than active usage.

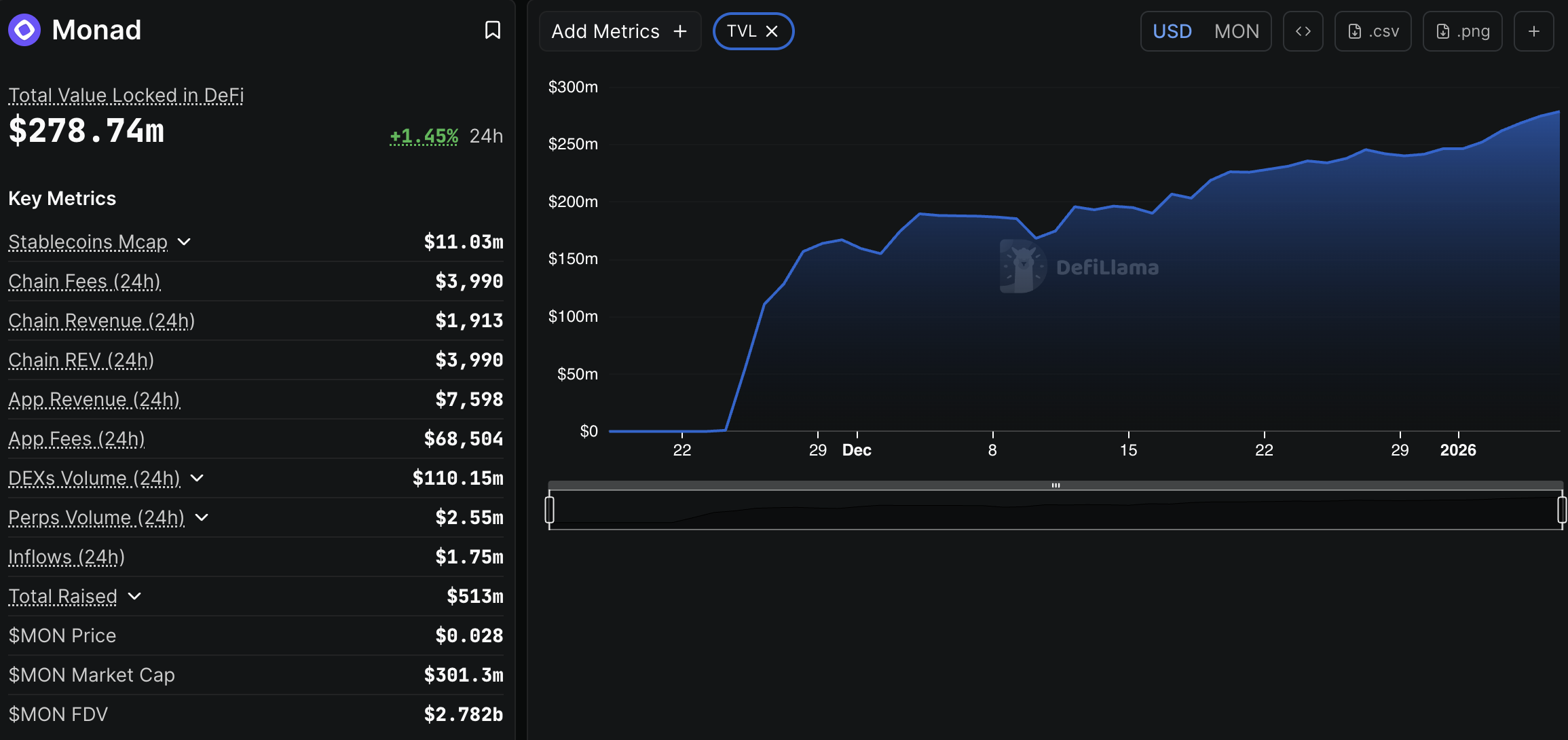

7. Monad

Monad comes in seventh place with 48.52% growth in December 2025. Monad is a high-performance Layer-1 blockchain fully compatible with the EVM. It achieves 10,000 TPS, 0.4s block times, and 0.8s finality through parallel execution, optimistic consensus (MonadBFT), and custom optimizations like MonadDb and JIT compilation, all built in C++/Rust. Developers port Ethereum dApps seamlessly for scalable DeFi and gaming, powered by $MON token for gas, staking, and governance. Its TVL is valued at $278.74 million.

Top protocols that drive TVL Growth for Monad:

| Protocols | TVL Growth (Dec 2025) |

| Quantus Lend | +543% |

| Neverland | +477% |

| Kintsu | +309% |

8. Ink

Ink comes in eighth place with 37.34% growth in December 2025. Ink is a decentralized blockchain platform focused on secure, scalable, and efficient solutions for digital asset management and smart contract deployment. It aims to empower developers and enterprises with innovative tools for a seamless blockchain experience. Its TVL is now valued at $501.3 million.

Top protocol that drives TVL Growth for Ink:

| Protocols | TVL Growth (Dec 2025) |

| Uniswap | +484% |

| Nado | +137% |

9. Starknet

Starknet comes at ninth with 20.65% growth in December 2025. Starknet is an Ethereum Layer 2 (L2) validity-rollup (ZK-rollup) using STARK proofs for massive scalability. It bundles transactions off-chain into a single proof verified on Ethereum, slashing costs and boosting throughput to thousands of TPS while preserving security. It powers dApps in DeFi, gaming, and beyond, with growing Bitcoin interoperability. Its TVL is now valued at $265.82 million.

Top protocols that drive TVL Growth for Starknet:

| Protocols | TVL Growth (Dec 2025) |

| Extended | +40.77% |

| Troves | +38.53% |

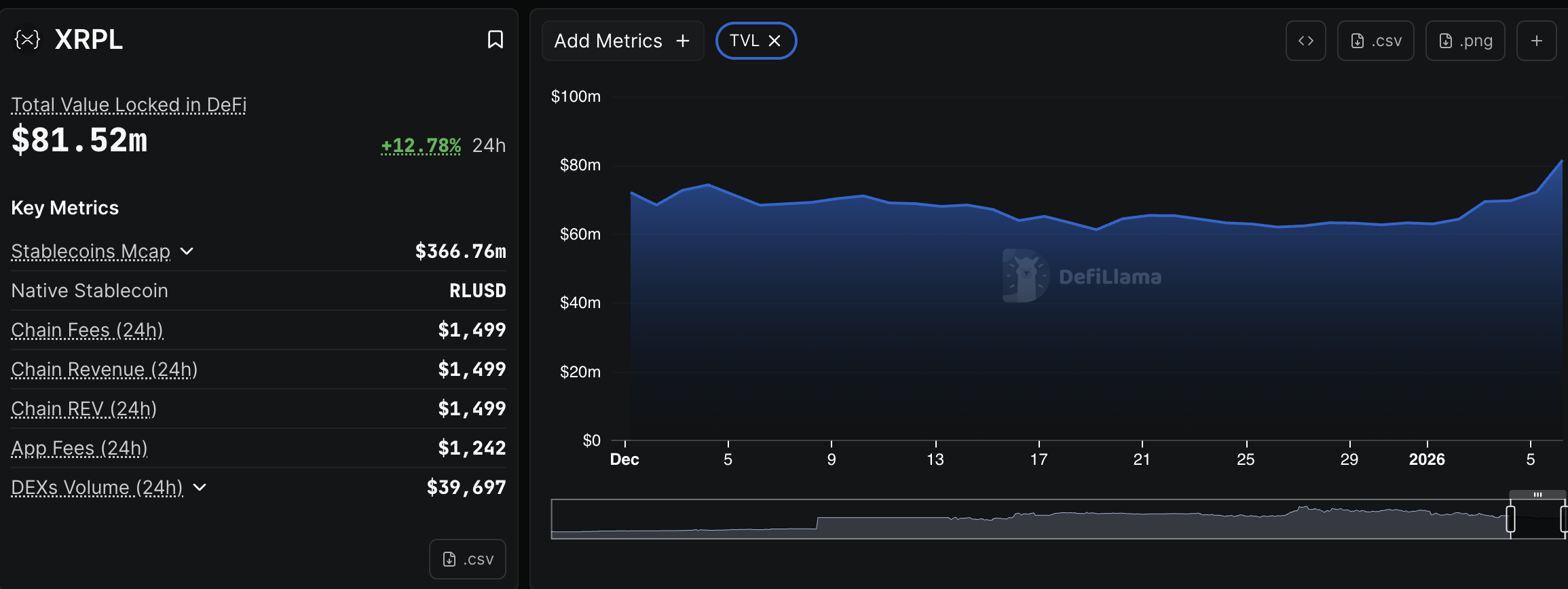

10. XRPL

XRPL comes at tenth with 18.77% growth in December 2025. The XRP Ledger (XRPL) is a decentralized, public blockchain launched in 2012 for fast, low-cost payments. It uses a consensus protocol with 150+ validators to confirm transactions in 3-5 seconds, without energy-intensive mining. Native token XRP enables efficient global transfers; supports DeFi, NFTs, and tokenization. Sustainable and business-focused. Its TVL is now valued at $81.52 million.

Top protocol that drives TVL Growth for XRPL:

| Protocols | TVL Growth (Dec 2025) |

| NEAR Intents | +34.91% |

| Doppler Finance | +29.38% |

Conclusion

In the dynamic landscape of decentralized finance (DeFi), tracking the Total Value Locked (TVL) across various blockchains provides invaluable insights into market trends and investor confidence. This analysis, based on data from DeFi Llama, highlights the top 10 blockchains that have experienced significant growth in TVL over December 2025, with a minimum TVL of $10 million.

Leave a Comment