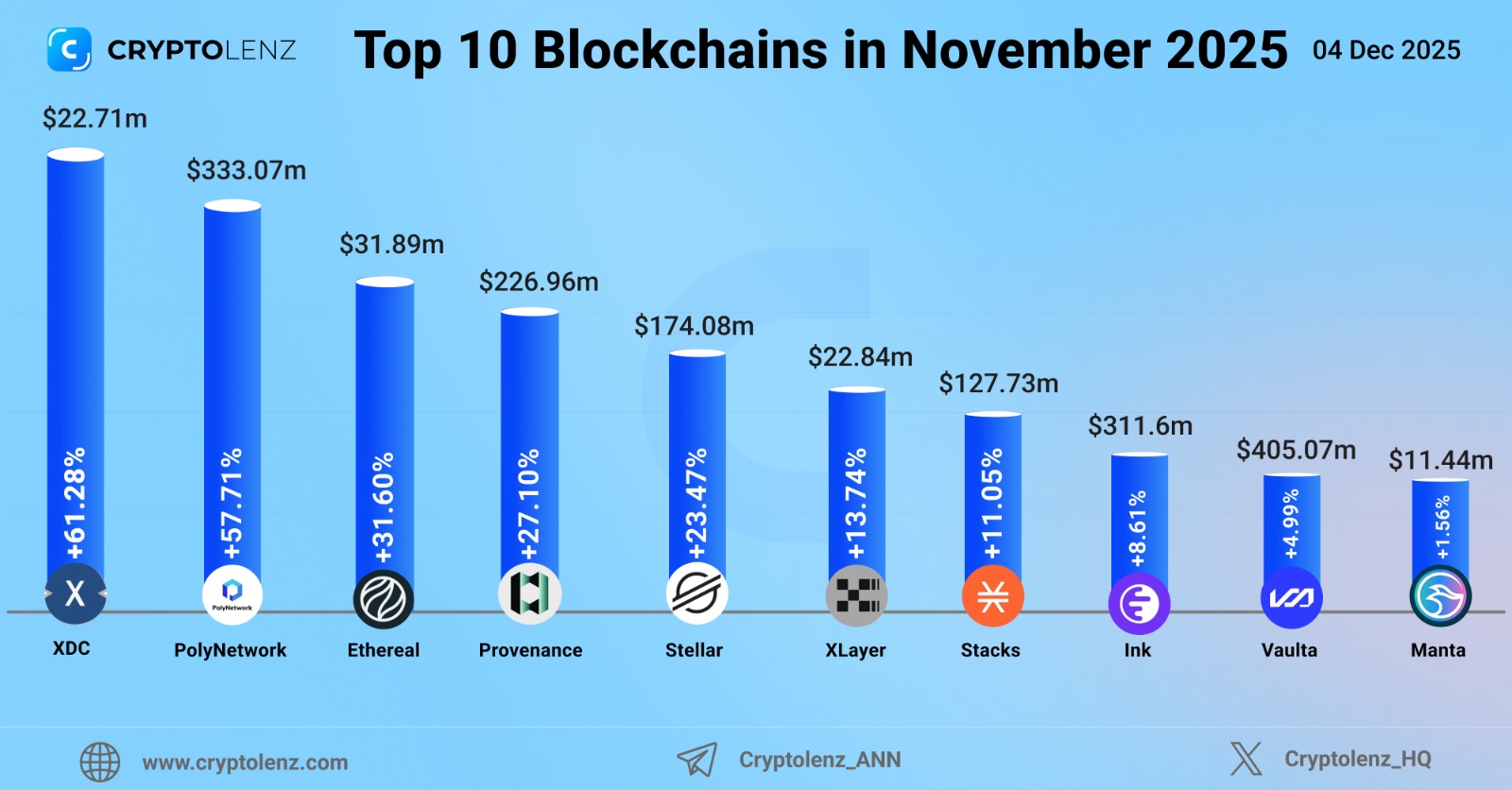

Top 10 Blockchains in November 2025 by TVL Growth

The DeFi landscape continues to evolve with blockchain ecosystems competing for dominance through innovative applications and strategic partnerships. Total Value Locked (TVL) is one of the key metrics to measure the health and attractiveness of these ecosystems. In this article, we have compiled a list of the top 10 blockchains in November 2025 by TVL growth, with a minimum Range of $10 million, using data from DefiLlama, a leading DeFi analytics platform.

What is TVL?

Total Value Locked (TVL) is a key metric in the decentralized finance (DeFi) ecosystem that represents the total U.S. dollar value of digital assets that are currently locked in DeFi platforms. These assets can include cryptocurrencies, stablecoins, liquidity tokens, and other digital assets used for various purposes such as staking, liquidity provision, and yield farming. It serves as an indicator of a DeFi platform's health and popularity, reflecting user trust and engagement.

Top 10 Blockchains in November 2025 by TVL Growth

The Following chains saw the highest TVL growth in November 2025

1. XDC

2. PolyNetwork

3. Ethereal

4. Provenance

5. Stellar

6. XLayer

7. Stacks

8. Ink

9. Vaulta

10. Manta

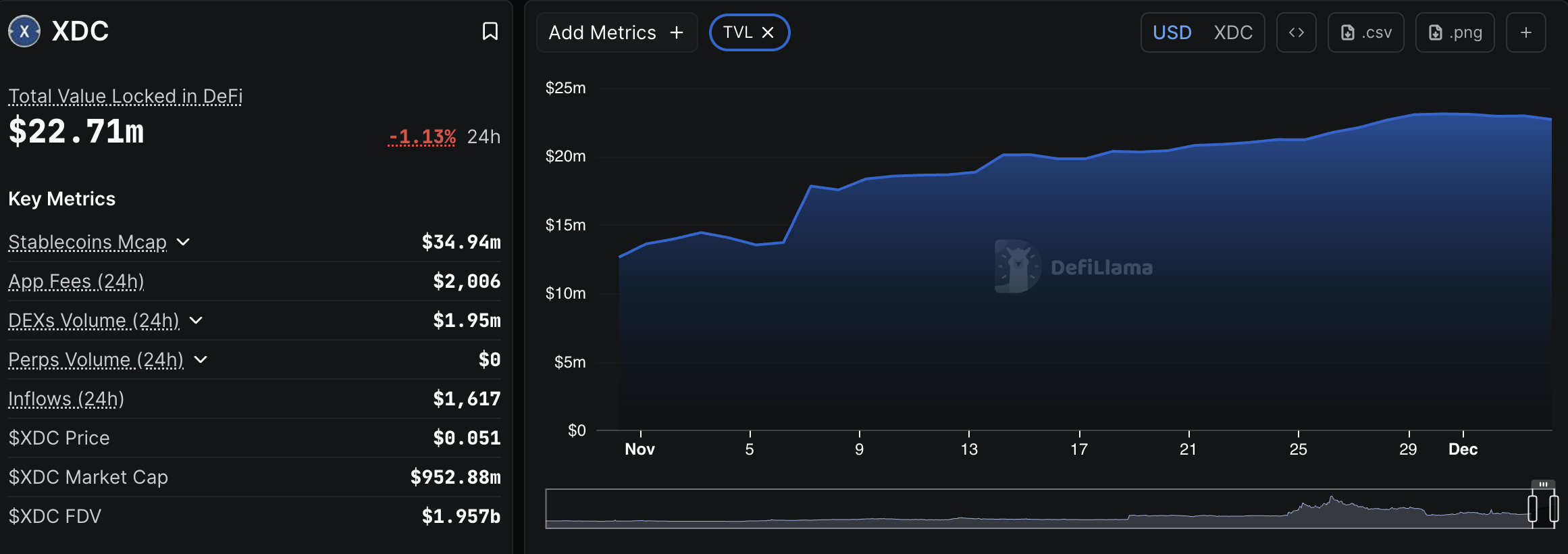

1. XDC

XDC tops the table with 61.28% growth in November 2025. The XDC is a high-performance, enterprise-grade hybrid blockchain built for global trade and finance. It combines public and private chains with EVM compatibility, enabling fast transactions (2000+ TPS), near-zero fees, and energy-efficient delegated proof-of-stake consensus. It offers secure, transparent, and scalable solutions for businesses and institutions worldwide. Its TVL is now valued at $22.71 million.

Top protocols that drive TVL Growth for XDC:

| Protocol | TVL Growth (Nov 2025) |

| Liqi | +683% |

| PrimeFi | +634% |

| Uniswap | +111% |

2. PolyNetwork

PolyNetwork comes on second place with 57.71% growth in November 2025. PolyNetwork was a cross-chain interoperability protocol enabling asset transfers across over 20 blockchains like Ethereum, BSC, and Polygon via smart contracts and bridges, fostering DeFi and Web3 infrastructure. It gained notoriety in August 2021 after a massive $611 million hack exploited access control flaws in its cross-chain contracts. Facing repeated exploits and shifting market conditions, PolyNetwork fully terminated all services on September 30, 2024. Despite this, DefiLlama continues displaying its TVL at around $333.07 million as the platform tracks on-chain locked value via automated smart contract queries even for inactive or shutdown protocols, reflecting residual liquidity rather than active usage.

3. Ethereal

Ethereal comes in third place with 31.60% growth in November 2025. Ethereal is a Layer-1 blockchain designed for scalable, secure, and gas-free transactions. It supports EVM-compatible decentralized apps, DeFi protocols, and Web3 gaming with institutional-grade PoS BFT security. Ethereal also powers a decentralized exchange (DEX) offering deep liquidity and fast execution. Its TVL is now valued at $31.89 million.

Top protocols that drive TVL Growth for Ethereal:

| Protocol | TVL Growth (Nov 2025) |

| Ethereal DEX | +21.19% |

4. Provenance

Provenance comes in fourth place with 27.10% growth in November 2025. Provenance is a secure, scalable platform designed to enhance transparency and trust in financial services and supply chains. It enables easy asset tokenization, streamlined compliance, and verifiable data sharing, empowering businesses with decentralized trust and operational efficiency. Its TVL is now valued at $226.96 million.

Top protocols that drive TVL Growth for Provenance:

| Protocol | TVL Growth (Nov 2025) |

| Figure Markets | +25.98% |

5. Stellar

Stellar comes in fifth place with 23.47% growth in November 2025. Stellar is a decentralized, public blockchain network designed for fast, low-cost payments, asset tokenization, and DeFi applications. It supports borderless financial services through tools for developers, institutions, and innovators, with features like a built-in decentralized exchange and native smart contracts. Its TVL is now valued at $174.08 million.

Top protocols that drive TVL Growth for Stellar:

| Protocol | TVL Growth (Nov 2025) |

| Blend | +84.53% |

| Aquarius Stellar | +2.88% |

6. XLayer

XLayer comes in sixth place with 13.74% growth in November 2025. XLayer is a Layer 2 scaling solution for Ethereum developed by OKX. It is an EVM-compatible, zero-knowledge (zk) rollup blockchain built with Polygon CDK and optimized for low-cost decentralized finance (DeFi), payments, and real-world asset applications. Its TVL is now valued at $22.85 million.

Top protocols that drive TVL Growth for XLayer:

| Protocol | TVL Growth (Nov 2025) |

| PotatoSwap | +18.91% |

| OkieSwap | +10.72% |

7. Stacks

Stacks comes in fourth place with 11.05% growth in November 2025. Stacks is a leading Bitcoin Layer-2 blockchain enabling smart contracts, DeFi, and apps that settle on Bitcoin for unmatched security via Proof of Transfer (PoX). It uses Clarity language, supports sBTC (1:1 BTC asset), and allows STX holders to earn BTC through stacking. Microblocks boost scalability while leveraging Bitcoin's network effects. Its TVL is valued at $127.73 million.

Top protocols that drive TVL Growth for Stacks:

| Protocol | TVL Growth (Nov 2025) |

| Brotocol | +777285% |

| UWU Protocol | +4.23% |

8. Ink

Ink comes in eighth place with 8.61% growth in November 2025. Ink is a decentralized blockchain platform focused on secure, scalable, and efficient solutions for digital asset management and smart contract deployment. It aims to empower developers and enterprises with innovative tools for a seamless blockchain experience. Its TVL is now valued at $311.6 million.

Top protocol that drives TVL Growth for Ink:

| Protocol | TVL Growth (Nov 2025) |

| Securitize | +10002018% |

| Uniswap | +755% |

| vfat.io | +131% |

| Velodrome | +123% |

9. Vaulta

Vaulta comes at ninth with 4.99% growth in November 2025. Vaulta is a high-performance Layer 1 blockchain designed as the operating system for Web3 banking and open finance. It offers fast, scalable, and secure transactions with 10,000+ TPS and supports EVM and C++ smart contracts. Vaulta integrates native Bitcoin support and features trustless inter-blockchain communication for seamless asset interoperability across chains. Its TVL is now valued at $405.07 million.

Top protocols that drive TVL Growth for Vaulta:

| Protocol | TVL Growth (Nov 2025) |

| SportBet | +577% |

| DolphinSwap | +83.41% |

| Alcor Exchange | +50.25% |

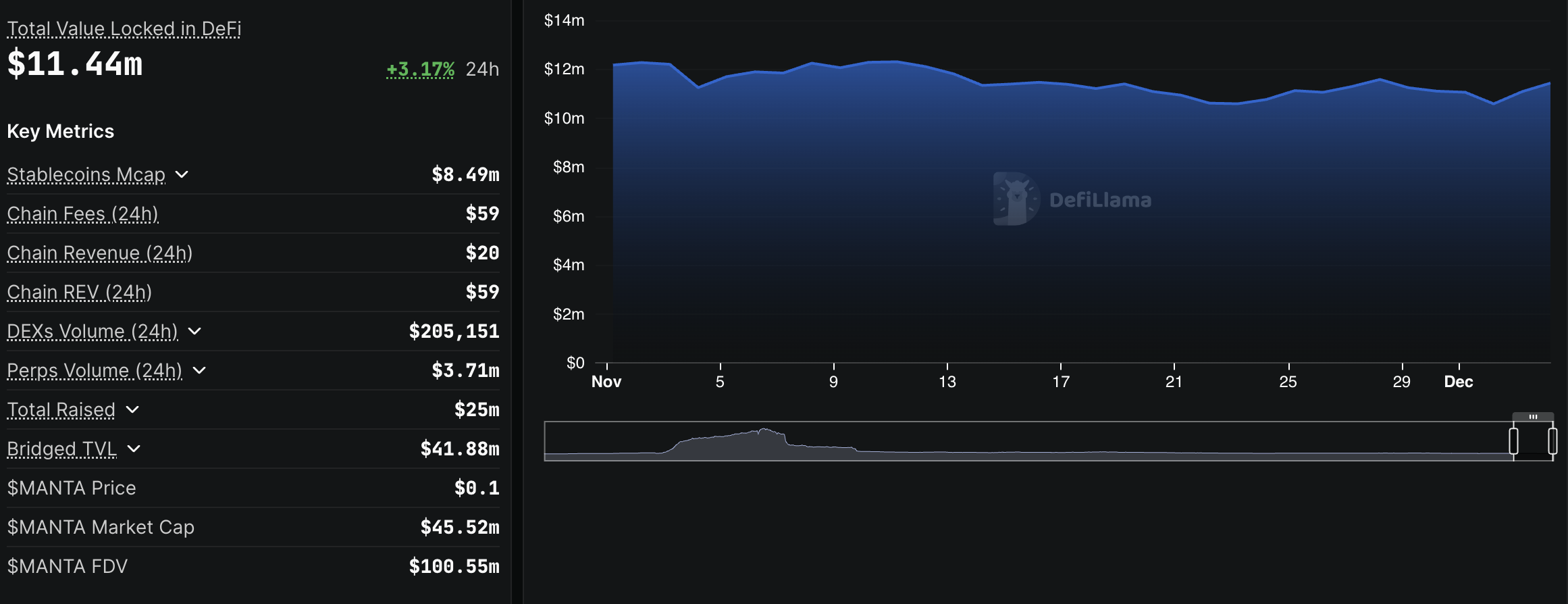

10. Manta

Manta comes at tenth with 1.56% growth in November 2025. Manta Network is a privacy-focused blockchain providing decentralized finance (DeFi) and Web3 privacy solutions. It uses zero-knowledge proofs for shielded transactions, enabling secure, private trading, payments, and interoperable DeFi on a scalable, interoperable Substrate-based network. Its TVL is now valued at $11.44 million.

Top protocol that drives TVL Growth for Manta:

| Protocol | TVL Growth (Nov 2025) |

| Steer Protocol | +29.70% |

| Quickswap | +21.30% |

Conclusion

In the dynamic landscape of decentralized finance (DeFi), tracking the Total Value Locked (TVL) across various blockchains provides invaluable insights into market trends and investor confidence. This analysis, based on data from DeFi Llama, highlights the top 10 blockchains that have experienced significant growth in TVL over November, with a minimum TVL of $10 million.

Leave a Comment