Uniswap burned 100 million UNI Tokens

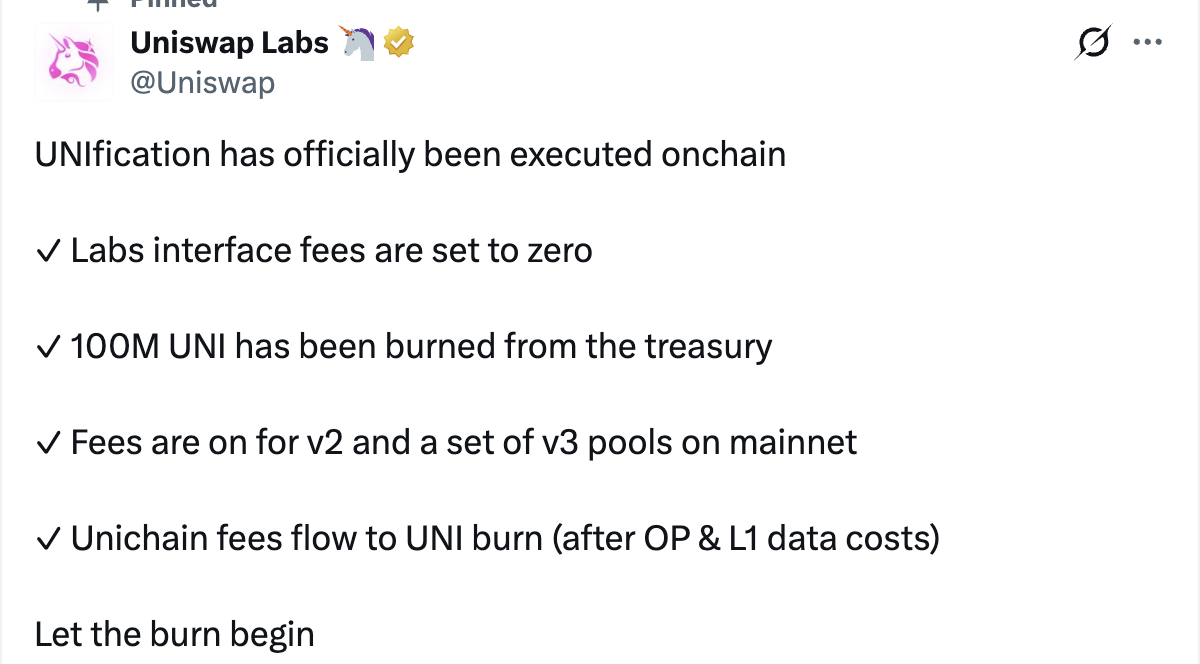

Uniswap Labs announced the burning of 100 million UNI tokens on December 28, 2025, wiping out roughly 4.76% of the governance token's total supply. This aggressive token burn, executed via a multisig wallet directly to a dead address, arrives amid UNI's price hovering around $12.50, sparking debates on scarcity, value accrual, and the protocol's long-term vision. Coming just weeks after governance proposal UNI-20251215 passed with overwhelming support, the move signals Uniswap's renewed focus on sustainability in a maturing DeFi ecosystem battered by regulatory headwinds and competition.

Image Source: Uniswap

What Happened and Why Now?

Uniswap's treasury held over 600 million UNI pre-burn, accumulated from protocol fees and early allocations. The 100 million UNI, valued at approximately $1.25 billion at current prices, was torched in a single transaction, confirmed on Etherscan as irreversible. Proponents argue this reduces circulating supply from 2.1 billion to under 2 billion, potentially boosting scarcity and countering years of token unlocks that diluted holder sentiment. UNI has underperformed peers like AAVE and COMP in 2025, down 15% YTD despite Ethereum's rally. This isn't Uniswap's first rodeo, but scale here dwarfs them, positioning it as a deflationary pivot akin to Binance's BNB quarterly burns.

UNI Surges 8% in Hours

News spread like wildfire across Crypto Twitter, with UNI jumping 8% to $13.45 within hours, reaching an intraday high of $14 before settling. Trading volume spiked 250% to $850 million on Uniswap V4 itself, underscoring poetic irony. Analysts at Messari noted, "This burn reframes UNI as a true value-capture asset," while on-chain metrics show whale accumulation: addresses holding 100k+ UNI added 2.5 million tokens in the past week. Broader DeFi felt the tremor. Competitors like SushiSwap saw 3% dips, fearing Uniswap's dominance might solidify. Bitcoin held steady at $98,000, but altcoin sentiment buoyed, with total DeFi TVL climbing 1.2% to $145 billion. Skeptics warn of pump-and-dump risks, pointing to past burns' fleeting rallies, but on-chain conviction metrics suggest longer-term holder confidence.

Strategic Implications

Beyond optics, the burn fuels Uniswap's roadmap. It clears the fiscal runway for V5 hooks, promising dynamic fees and singleton contracts for gas savings up to 99%. Governance now eyes a "fee switch" to direct 20% of V3/V4 fees to UNI stakers, potentially generating $400 million annually at current volumes. Community reaction splits hairs: Bulls hail deflationary discipline; bears decry opportunity cost versus R&D investment. Uniswap Foundation Chair Hayden Adams tweeted, "Burns are table stakes; real alpha is in protocol-owned liquidity." With 376 million UNI still vesting over four years, future burns loom, but this cements Uniswap's anti-dilution stance amid SEC scrutiny on DEXs.

Looking Ahead

Uniswap's mega-burn isn't isolated; MakerDAO also burned 15k MKR last month, signaling a trend. For retail holders, it means potential price floors; for devs, treasury signals prioritizing innovation. As Ethereum's L2s like Base explode (Uniswap V4 live there since October), expect intensified fee debates.

Leave a Comment